Selecting private bonds might be tricky, time-drinking, and you can high priced. Bond ETFs enables you to pick a standard portfolio of bonds on the mouse click of a button, for a known rate and you can relatively reduced percentage. Picking private bonds will be tricky, time-consuming, and pricey; bond ETFs allows you to buy a standard collection of securities for the click from a button, for a known price and apparently reduced payment. Securities is straight down-chance minimizing-go back investments than simply carries, which makes them an extremely important component of a well-balanced financing collection, specifically for old or even more traditional traders. Matches period on the date horizon and you may borrowing from the bank high quality for the chance threshold. The initial step is choosing just how long you intend to hang the new funding and exactly how much chance you might manage.

You’ll have to spend government taxation for the focus from these ties, but the desire is generally excused away from condition taxation. As they are very safer, productivity are often a minimal offered, and repayments will most likely not continue which have inflation. Whether or not you determine to focus on an economic elite group or thinking-take control of your investment, fixed-income investment is going to be a core part of your own investing approach.

- It is also unhealthy whenever Treasury ties pay high interest rates than simply corporate securities or mortgage loans with the same readiness.

- They’re able to be also your main income source, according to your financial requirements and personal needs.

- Once you’ve calculated your dream stage and you may credit high quality, narrow your options because of the selection to possess lowest-rates and you may liquid thread ETFs.

- Too, people fixed income security marketed otherwise used before maturity can get be at the mercy of loss.

- Types of MBS issuers were Ginnie Mae, Federal national mortgage association, and you may Freddie Mac computer.

Thread ETFs mode by pooling a container of ties, and therefore generally change more than-the-prevent (OTC). Although not, these types of ties try packaged on the an enthusiastic ETF in order to trading for the transfers, enabling https://www.s-i-solutions.com/options-trading-canada/ investors to shop for and sell her or him just like holds. Whether you’re seeking balances, produce, or a good hedge facing stock market downturns, bond ETFs provide a very important services to possess buyers of all sorts. Compared to brings, ties may seem boring, nevertheless they gamble a serious role inside profile diversification. Bond ETFs lessen complete exposure, create consistent money, and you will act as a good tool for portfolio rebalancing, specifically throughout the periods away from industry volatility. Ties are inversely synchronised so you can rates, i.elizabeth., just after rates of interest rise, thread cost normally slide, and vice-versa.

Is treasury ties a lot better than Dvds?

If you are to shop for securities can be easy, it’s however important to recognize how bonds work, how they’re also charged and you may where you are able to have them one which just dedicate. GOBankingRates’ article people are invested in bringing you objective reviews and you can advice. I fool around with study-motivated techniques to test lending products and you can services – all of our analysis and you will ratings commonly dependent on business owners.

The price will get refuse if you attempt to sell a thread just before its maturity, the fresh date at which a thread issuer intends to pay back the brand new dominating and you may (typically) can make a final attention percentage. Particular bond ETFs keep civil securities, which can be exempt out of government taxation and you may, occasionally, county taxation, causing them to a tax-successful money choice for buyers inside the higher tax supports. Concurrently, some thread ETFs play with ways to get rid of nonexempt money gains distributions, then boosting their income tax profile. However, if the interest levels boost and also the discount speed to own securities for example it rises to 5%, the new 4% coupon is no longer attractive. Alternatively, the bond’s rate tend to drop off market for a cheap price than the the fresh face value up until its productive go back is actually 5%. Very bonds offer a fixed rate of interest and therefore becomes more attractive if the interest levels decline, pushing up request plus the thread’s price.

As a whole, the bond market is volatile, and fixed income securities bring interest rate risk. Unlike individual ties, extremely thread money don’t possess a great maturity date, so carrying them up until readiness to quit losings as a result of price volatility isn’t feasible. People fixed-income protection marketed otherwise redeemed before readiness can get getting susceptible to losses. Area of the earnings you receive may be susceptible to state and federal income taxes, such as the federal solution lowest tax.

Federal government bonds

The fresh issuer promises to spend the money for individual desire across the name of your own thread (constantly twice a year) and return the primary to the newest trader in the event the bond develops. When you’re U.S. Treasury otherwise authorities company securities give big protection against borrowing risk, they don’t protect traders facing speed change on account of changing rates. Industry beliefs from government securities commonly guaranteed that will change however these ties try guaranteed from what fast commission of prominent and you can interest.

- Yet not, when you’re ties try seemingly lowest exposure, he’s got certain weakened parts, especially if inflation and you can rates raise.

- General creditors you are going to is personnel, designers and you will services.

- Discount rates This is actually the yearly percentage of attention the fresh issuer will pay a person who owns a thread.

- An appearing stock market one draws funding assets from the expenses out of ties or an increasing regulators budget shortage can also be harm productivity to the ties, but absolutely nothing cripples him or her for instance the “I” term.

- Because the a notion try out, imagine the newest Treasury were able to matter $dos trillion inside BitBonds during the step 1% desire.

Individual otherwise organization investors just who purchase this type of ties like to provide money to the organization in return for desire costs (the bond voucher) as well as the come back of your own dominating at the conclusion of maturity. A few options that come with a thread—borrowing quality and time and energy to readiness—is the dominant determinants away from an excellent bond’s voucher rates. If the issuer has a dismal credit score, the possibility of default are deeper, and these securities shell out far more desire. Ties that have a long readiness day along with usually pay a high interest. So it large compensation is really because the fresh bondholder is far more met with rate of interest and you can rising prices threats for an extended period.

Regular income distributions

Junk ties are usually seen as much more associated with holds than simply with other bonds, and usually do better in the event the discount is growing swiftly and you can carries try rising. Actually, you can buy $twenty five “baby bond” equipment, and often those people are more effective and much more drinking water than simply securities with a face value from $step one,one hundred thousand. The brand new $25 equipment are really simple to buy because they are listed just including holds or ETF devices.

For many who’re looking for the high possible pay, speaking of recommended because they typically shell out large focus cost than other bonds. The newest downside is actually, the businesses one to matter are usually likely to standard than simply the us government. For this reason it’s vital that you look into the thread’s rating to determine just how much risk you might be using up. Saylor’s bitcoin treasury company have routinely provided vast amounts of cash inside the corporate loans from the a good mindboggling 0% coupon price. As the people commonly to shop for Means (formerly “MicroStrategy”) ties to safer give however, to help you experience possible upside for the stock. This type of bonds is “convertible” in the sense they can become transformed into stock inside the the near future.

Ideas on how to Estimate the brand new Percentage Go back away from a Treasury Bill

It is really not just the bond market that is roiled by the Trump’s on-again, off-again tariff risks; he has compromised believe certainly one of team leadership and you will consumers and you can sent carries tumbling. The fresh Provided is within a great “rigorous place,” authored Michael Gapen, captain U.S. economist at the Morgan Stanley, who observes the newest main lender reducing rates if this year. Specific regarding the areas has “impractical standards” about how precisely far the newest Given can cut this year, the guy wrote while the tariffs could lead to inflation rearing their lead again. Concerns over a downturn is “causing areas to quickly reevaluate just how much lengthened the brand new You.S. macro achievement tale is also remain,” experts during the Dutch lender ING composed inside a research mention. But there’s a chance you to investors try “overdoing the brand new gloom,” it extra. The following moves in the Government Set aside plus the stock market you may inform what investors from the bond business is going to do 2nd.

What’s the unmarried greatest chance to help you thread output?

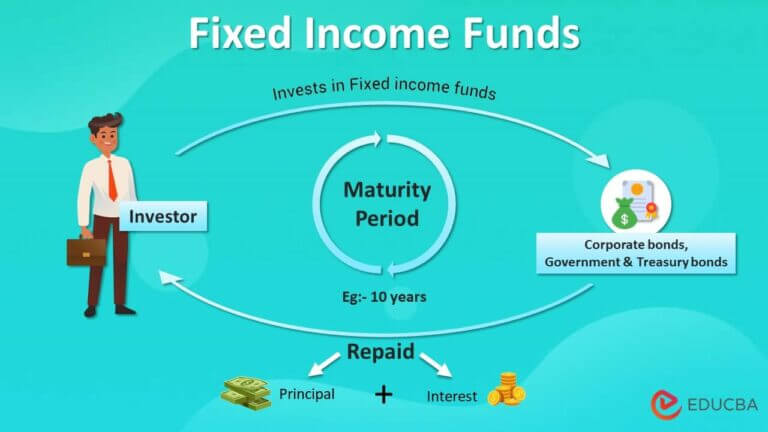

A thread is a loan made to a pals or bodies in exchange for money. The amount of money is usually paid every day and you will is usually called a discount percentage. Of a lot thread ETFs hold numerous if not thousands of securities, comprising certain maturities, credit features, and issuers.

Thread credit scores make it easier to comprehend the standard exposure involved with the bond investments. They also highly recommend the chance that the issuer will be able in order to dependably pay investors the text’s discount rate. Financial institutions or other lending associations pond mortgage loans and you may “securitize” them thus traders can obtain securities which might be backed by earnings away from somebody settling their mortgages. Samples of MBS issuers were Ginnie Mae, Fannie mae, and you will Freddie Mac. Mortgage-recognized securities have a give one to usually is higher than high-degrees corporate securities.