Articles

You can look for local rental services online due to an internet site such as Roofstock. This site lets sellers of vacant property primed to possess clients to listing the functions, encourages the newest to purchase procedure, and you can assigns a property owner on the the new buyer. You to vintage means to fix invest in home is to buy and you may book a home otherwise element of it. Such as REITs, RELPs always individual a share from functions but differ in the structure and they are considerably better to own highest-net-really worth traders. Mainly, RELPs is a type of private security — that is, they aren’t exchanged on the personal exchanges. Some financing tips are made to own experienced and you will accredited people, although some work better designed for novices.

File

Errors, yet not, could cause pressures from taxing government. Citizen hinges on domicile, situs from possessions, and application of a great treaty. You’re able use the File Publish Unit to react electronically in order to eligible Internal revenue service sees and characters by properly uploading required files on the web because of Internal revenue service.gov. Go to Internal revenue service.gov/Account in order to securely availability information about your own government income tax membership.

Withholding out of Tax

Awarded from the personal loan providers and following direction place from the Fannie mae and you will Freddie Mac computer, these types of fund usually need highest fico scores, down payments, and you will underwriting conditions than just mortgages for primary homes. They’re financed that have power (borrowing), allowing you to benefit when you’re spending less money initial. Yet not, traders can simply getting weighed down by many financing possibilities. Concurrently, you will have to determine down money, the creditworthiness, interest rates, and how far loans you have. But anybody else, such Fundrise and you will RealtyMogul, provide people whom wear’t satisfy those individuals minimums — also known as nonaccredited traders — use of assets it wouldn’t if not manage to purchase.

The new transferee, the fresh transferee’s representative, and/or transferor will get consult a great withholding certification. The brand new Irs will generally work within these requests within 3 months just after bill of a whole software such as the TINs of all the fresh functions to the exchange. A great transferor you to can be applied to have a good withholding certification need alert the new transferee, in writing, your certification could have been applied for at the time out of or perhaps the time until the import.

Another-richest home baron in the usa—Stephen Ross, founder of the Related Organizations, and that centered the brand new Hudson M development in Nyc—try the most significant a home loser over the past 12 months. America’s downtowns try struggling, that have empty office houses and shuttered merchandising weighing down possessions values inside the cities nationwide. Actually, the nation’s richest landlords are already richer now than just these people were inside 2022. You will find 25 billionaires to the 2023 Forbes 400 list which primarily owe the luck in order to a house. These types of property tycoons are worth a collaborative $139 billion—regarding the $5 billion more the fresh 24 within the a home was well worth on the 2022 positions.

- The degree of tax you need to keep back determines the brand new volume of your places.

- When you yourself have a great deal currency that you’re concerned with estate income tax, there are 2 ways to think.

- Fellow The newest Yorkers Charles Cohen and you will Jerry Speyer, each of whom features several work environment systems inside Manhattan, noticed the fortunes slip by the $700 million and you may $500 million, respectively.

- Guidance extracted from the fresh declaration you could end up checking account denial.

- Ordinary debt obligations (e.grams., promissory notes and you may ties) owned and you can stored from the non.U.S.

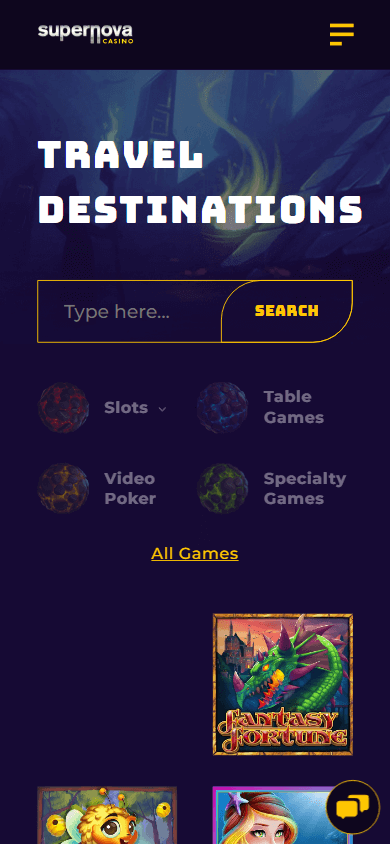

When you’re searching for a good QDOT, understand ” https://vogueplay.com/tz/gday-casino-review/ QDOTs for Noncitizen Partners” and you can keep in touch with a talented property thought attorneys. To complete its goal, the newest trust have to follow specific challenging legal laws. If you are a great You.S. citizen or citizen of the You, get in touch with skilled income tax counsel who’ll give an explanation for believed options one will get exist regarding gifting possessions.

Mary, a citizen and you can citizen from Ireland, check outs the usa and gains $5,100000 to play a slot machine game in the a casino. Under the treaty that have Ireland, the new payouts commonly susceptible to U.S. tax. Mary says the brand new treaty pros by providing an application W-8BEN on the local casino up on profitable at the casino slot games. The brand new gambling establishment are an affirmation agent that will request a keen ITIN to the an enthusiastic expedited foundation. An excellent U.S. or foreign TIN (while the appropriate) need generally get on a good withholding certificate if the useful proprietor is actually saying some of the after the. Understand the Instructions to possess Function 8957 to have information on whether a great GIIN becomes necessary..

Having local rental services is a good choice for individuals who have do-it-your self (DIY) feel, the newest perseverance to handle tenants, as well as the time for you get the job done safely. We questioned another using professionals observe what they got to state regarding the finest a house investing software. Newbies can be think about the pursuing the tips to know about home paying. Even when Shows tend to make it look easy, “flipping” stays perhaps one of the most go out-ingesting and you may high priced a method to invest in a property. Yet not, in addition, it gets the potential to create the biggest progress. To be a profitable flipper, it is best to be equipped for unanticipated difficulties such as finances expands, errors, a longer restoration timeline, and issues selling in the business.

An excellent WT can be remove as the direct beneficiaries otherwise people those people secondary beneficiaries or owners of the fresh WT by which they is applicable mutual membership procedures or perhaps the company choice (discussed after). A good WT need if not topic a type 1042-S to every recipient otherwise proprietor to the extent it is required to get it done under the WT agreement. You can also issue a single Form 1042-S for all payments you make to help you a good WT besides repayments where the new entity will not try to be a WT. You can even, however, has Form 1099 conditions definitely indirect beneficiaries otherwise owners of an excellent WT that will be You.S. taxable receiver. It does not have to be taxed from the treaty country for the for example product, nevertheless product must be accounted for since the entity’s money, maybe not the attention holders’ money, within the rules of one’s treaty country whose pact it’s invoking. It ought to as well as see any other conditions for stating benefits, including the specifications of your own restriction for the advantages article, or no, in the treaty.

So it designation includes solitary-loved ones products, such properties, and some multiple-family products, for example townhouses, duplexes, triplexes, fourplexes, and sometimes condominiums and you can quicker flat buildings. Basically, a creating with well over five house systems is recognized as commercial property, but this will vary. Really the only earnestly addressed ETF to your all of our listing, the fresh JPMorgan Realty Income ETF distinguishes in itself in the a home category by delving for the a little lower volatility holdings. You to definitely basically allows it to give overall performance balance whenever locations waver. The newest finance targets lower produce businesses but with large money progress estimated for another three to five decades than their Morningstar class mediocre.

To have withholding one to applies to the new mood out of USRPI, come across U.S. A foreign people could possibly get claim a treaty benefit to the dividends repaid by a different firm on the extent the new returns is paid away from money and you may earnings in the per year where overseas corporation wasn’t susceptible to the brand new part profits income tax. However, you could pertain less speed of withholding below a full time income taxation treaty merely lower than laws just like the regulations you to use so you can treaty advantages advertised for the branch focus paid off because of the a foreign business. A great treaty can get reduce the rate away from withholding to your returns out of whatever basically enforce under the pact in case your stockholder possess a certain part of the brand new voting inventory of your business when withholding under part 4 cannot implement. Usually, which preferential price applies on condition that the new shareholder individually owns the fresh necessary fee, while some treaties enable the percentage becoming came across by the direct or secondary ownership. The brand new preferential price could possibly get apply to the fresh payment out of a considered dividend less than part 304(a)(1).

Payment: Monthly

Finished withholding of cash income tax always applies to the earnings, salaries, and other buy teaching and search paid from the a good U.S. informative business inside the period the fresh nonresident alien are training or performing look from the establishment. The last percentage away from compensation for independent private services could be entirely or partly excused of withholding during the statutory rates. That it different pertains to the very last payment from compensation, besides wages, for personal services made in america the alien wants to get of one withholding agent in the income tax 12 months. Of numerous taxation treaties, yet not, provide for an exclusion out of withholding for alimony money. A foreign useful owner doesn’t need to offer an application W-8 or documentary evidence for it exclusion.